Discount Future Cash Flows - Valuation Method

What is the DCF Method of Valuation?

- Marketing, Advertising, Sales & PR

- Accounting, Taxation, and Reporting

- Professionalism & Career Development

-

Law, Transactions, & Risk Management

Government, Legal System, Administrative Law, & Constitutional Law Legal Disputes - Civil & Criminal Law Agency Law HR, Employment, Labor, & Discrimination Business Entities, Corporate Governance & Ownership Business Transactions, Antitrust, & Securities Law Real Estate, Personal, & Intellectual Property Commercial Law: Contract, Payments, Security Interests, & Bankruptcy Consumer Protection Insurance & Risk Management Immigration Law Environmental Protection Law Inheritance, Estates, and Trusts

- Business Management & Operations

- Economics, Finance, & Analytics

What is the Discounted Future Cash Flow Method of Valuation?

The Discounted Cash Flow (DCF) method uses the projected future cash flows of the business after subtracting the operating expenses, taxes, changes in working capital, and capital expenditures. This figure is known as the free cash flow of the business because it accurately represents the cash available to interested parties, such as investors or debt holders.

These cash flows are then discounted to bring them back to present value. The discount rate is the cost of capital or the required return by investors given the risk associated with the venture.

What is the DCF formula?

where V0 is the value today (time 0),

E0 denotes expectations at time 0,

FCFt is the free cash flow at time t, and

r1, r2, are the discount rates of the first, second, and so on to all future periods.

If the discount rate does not change over time so that r1 = r2 = r3 the DCF formula can be stated as: The DCF approach may be used to value both the debt and equity of the company or just the company equity. When the formula is used to value the whole company, it is important to determine the weighted average cost of capital (WACC) associated with that business.

The WACC will account for the capital structure (the percentage of debt and equity used to finance the company). The WACC will serve as the discount rate for the future cash flows. If, however, the FCF is determined net of interest to debt holders, the discount factor should simply be the rate of return required by all stockholders.

The debt and equity in the company can be valued pursuant to the following steps. Estimate the future revenues of the company and subtract the operating expenses (including depreciation and amortization). This will yield the Earnings Before Interest and Taxes (EBIT) for each year.

Now subtract the taxes from this amount (which is generally a percentage of the EBIT amount). This yields the Net Operating Profit After Tax (NOPAT) for each annual cash flow.

Add back any operating expenses that did not result in an outlay of cash. This is generally depreciation and amortization. This is important, as these expenses do not reduce the actual free cash flow of the business. Then subtract amount amounts attributed to capital expenditures.

Also subtract any necessary increases in net working capital (NWC) required by the business in that year. Subtracting capital expenditures and increases in NWC is not an expense, but it does reduce the FCF available for the business in a given year. This amount is the projected FCF available to the business in that year.

Now you have a FCF for each year until the date of an intended exit event (such as sale or public offering).

The last year is obviously not the final year that the business can bring in revenue. So, for the last year, you will need to obtain a terminal value.

The terminal value of cash flows is derived from the assumption that the last year of cash flows will remain equal into perpetuity. The formula for determining a future cash flow in perpetuity is as follows: where g accounts for any stable growth rate of the cash flows over time.

The result is the terminal value attributable to the intended year of exit.

Now you should discount each years FCF, including the terminal value in the year of exit, using the WACC. This requires you to calculate the individual firms WACC based upon the capital structure (debt and equity). This is important as the required return from debt holders if far less than the required return from equity holders. Further, debt provides tax advantages (deductions) to the business based upon the interest paid to debt holders.

Equity financing, on the other hand, does not provide tax benefits for the dividends distributed to equity holders. Therefore, it is necessary to account for these discrepancies when valuing the business.

The benefit of interest payment deductions is incorporated for in the WACC calculation. The calculation is as follows. where, kd is the required rate of return for debt holders, ke is the required rate of return of stock holders, tx is the marginal tax rate, and D/A represents the firms debt to total assets, and E/A represent the firms Equity to total assets in the firms capital structure. D/A and E/A represent the total capital structure, and therefore must add up to one.

Think of it as all assets are either obtained via debt or shareholders equity (capital contribution or retained earnings).

The key figure relates to the available return on similar bonds (time and risk level) in the market. The key figure is determined by the required rate of return from shareholders given the level of risk of similar equity in the market.

Since the level of risk associated with equity is unique to the firm, the capital asset pricing model (CAPM) is used to calculate the key amount.

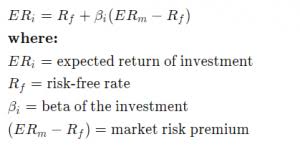

The CAPM formula is as follows:

E(Ri) = Expected Return

Rf = Risk free rate

= Beta

Rm = return on the market

The risk free rate is generally the U.S. treasury rate for the given period. The return on the market rate is the market rate for this type of equity on the open market. The difference between these two amounts is the premium associated with this equity above a risk-free investment. This amount is then multiplied by the Beta, which represents the historical rate of return attributable to this type of investment.

Collectively, this formula provides the expected return of investors in the company. You know have all of the elements necessary to value the whole company based on the capital structure and expected return from debt holders and equity holders.

The above formula demonstrates the process for valuing the debt and equity of the firm. To value just the equity of the firm (and not the debt), you must identify the free cash flow available to shareholders after all debt has been paid off.

In the FCF calculation, the FCF is adjusted by adding any new debt taken on by the company and subtracting any debt repayment. The FCF is then discounted at the cost of equity (derived from CAPM), rather than at the WACC rate.

Discounted Future Cash Flow Model

The discounted cash flow suffers from the above-stated difficulties, as well as other specific cash-flow related challenges. The difficulty in this method is that the capital structure must be weighted based upon a market risk premium (beta).

The beta can be difficult to identify in private companies and, as in the case of comparables, there may be few or no comparable private companies. Perhaps the most unreliable aspect of this method is that it relies upon the revenue projections for the company, which are often quite speculative and uncertain.

The adjusted present value method is a variation of this method that values cash flows from assets and then calculates tax savings separately.

This method is useful when the capital structure of the firm is changing or when the firm has significant net operating loss carry forward. However, the forward-looking nature of the financial projections is still speculative in nature.

Further, the CAPM model for determining the expected return on equity has been shown to have a number of flaws.