Keynesian Assumptions - Aggregate Supply and Demand Model

- Marketing, Advertising, Sales & PR

- Accounting, Taxation, and Reporting

- Professionalism & Career Development

-

Law, Transactions, & Risk Management

Government, Legal System, Administrative Law, & Constitutional Law Legal Disputes - Civil & Criminal Law Agency Law HR, Employment, Labor, & Discrimination Business Entities, Corporate Governance & Ownership Business Transactions, Antitrust, & Securities Law Real Estate, Personal, & Intellectual Property Commercial Law: Contract, Payments, Security Interests, & Bankruptcy Consumer Protection Insurance & Risk Management Immigration Law Environmental Protection Law Inheritance, Estates, and Trusts

- Business Management & Operations

- Economics, Finance, & Analytics

What are the Keynesian Assumptions in the Aggregate Demand and Aggregate Supply Model?

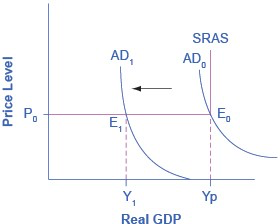

The AD/AS diagram illustrates two Keynesian assumptions—the importance of aggregate demand in causing recession and the stickiness of wages and prices. Note that because of the stickiness of wages and prices, the aggregate supply curve is flatter than either supply curve (labor or specific good). In fact, if wages and prices were so sticky that they did not fall at all, the aggregate supply curve would be completely flat below potential GDP.

This outcome is an important example of a macroeconomic externality, where what happens at the macro level is different from and inferior to what happens at the micro level. For example, a firm should respond to a decrease in demand for its product by cutting its price to increase sales. However, if all firms experience a decrease in demand for their products, sticky prices in the aggregate prevent aggregate demand from rebounding (which we would show as a movement along the AD curve in response to a lower price level).

The original equilibrium of this economy occurs where the aggregate demand function (AD0) intersects with AS. Since this intersection occurs at potential GDP (Yp), the economy is operating at full employment. When aggregate demand shifts to the left, all the adjustment occurs through decreased real GDP. There is no decrease in the price level. Since the equilibrium occurs at Y1, the economy experiences substantial unemployment.

This figure illustrates the two key assumptions behind Keynesian economics. A recession begins when aggregate demand declines from AD0 to AD1. The recession persists because of the assumption of fixed wages and prices, which makes the SRAS flat below potential GDP. If that were not the case, the price level would fall also, raising GDP and limiting the recession. Instead the intersection E1 occurs in the flat portion of the SRAS curve where GDP is less than potential.

Related Topics

- Keynesian Perspective of Aggregate Demand

- Recessionary and Inflationary Gap

- Consumption Expenditure

- Investment Expenditure

- Government Spending in Aggregate Demand

- Net Exports in Aggregate Demand

- Keynesian Economic Analysis

- Wage and Price Stickiness

- Coordination Argument of Wage Stickiness

- What are Menu Costs

- Keynesian Assumptions in the Aggregate Demand and Aggregate Supply Model

- Macroeconomic Externality

- Expenditure Multiplier

- The Phillips Curve

- Keynesian Approach to Unemployment and Inflation

- Keynesian Perspective on Market Forces

- NeoClassical Economics

- Long Run Potential GDP

- Physical Capital Affects Productivity

- Potential GDP in the Aggregate Demand Aggregate Supply Model

- Prices are Flexible in the Long Run

- Keynesian and NeoClassical View of Long-Run Aggregate Supply and Demand

- Speed of Macroeconomic Adjustment of Wages and Prices

- Paradox of Rationality

- Rational Expectations Theory

- Shapley Value

- Mechanism Design Theory

- What is the Adaptive Expectations Theory

- Measure Inflation Expectations

- Neoclassical Phillips Curve Tradeoff

- Neoclassical View of Unemployment

- Neoclassical View of Recessions

- Keynesian vs Neoclassical Macroeconomic Policy Recommendations