Potential GDP in the Aggregate Demand Aggregate Supply Model

How does Potential GDP affect the Aggregate Demand Aggregate Supply Model?

- Marketing, Advertising, Sales & PR

- Accounting, Taxation, and Reporting

- Professionalism & Career Development

-

Law, Transactions, & Risk Management

Government, Legal System, Administrative Law, & Constitutional Law Legal Disputes - Civil & Criminal Law Agency Law HR, Employment, Labor, & Discrimination Business Entities, Corporate Governance & Ownership Business Transactions, Antitrust, & Securities Law Real Estate, Personal, & Intellectual Property Commercial Law: Contract, Payments, Security Interests, & Bankruptcy Consumer Protection Insurance & Risk Management Immigration Law Environmental Protection Law Inheritance, Estates, and Trusts

- Business Management & Operations

- Economics, Finance, & Analytics

How does Potential GDP affect the Aggregate Demand Aggregate Supply Model?

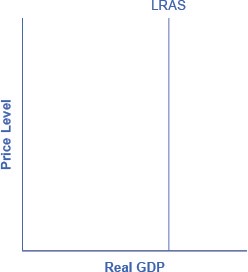

In the aggregate demand/aggregate supply model, we show potential GDP as a vertical line. Neoclassical economists who focus on potential GDP as the primary determinant of real GDP argue that the long-run aggregate supply curve is located at potential GDP—that is, we draw the long-run aggregate supply curve as a vertical line at the level of potential GDP. A vertical LRAS curve means that the level of aggregate supply (or potential GDP) will determine the economy's real GDP, regardless of the level of aggregate demand. Over time, increases in the quantity and quality of physical capital, increases in human capital, and technological advancements shift potential GDP and the vertical LRAS curve gradually to the right. Economists often describe this gradual increase in an economy's potential GDP as a nation's long-term economic growth.

In the neoclassical model, we draw the aggregate supply curve as a vertical line at the level of potential GDP. If AS is vertical, then it determines the level of real output, no matter where we draw the aggregate demand curve. Over time, the LRAS curve shifts to the right as productivity increases and potential GDP expands.

Related Topics

- Keynesian Perspective of Aggregate Demand

- Recessionary and Inflationary Gap

- Consumption Expenditure

- Investment Expenditure

- Government Spending in Aggregate Demand

- Net Exports in Aggregate Demand

- Keynesian Economic Analysis

- Wage and Price Stickiness

- Coordination Argument of Wage Stickiness

- What are Menu Costs

- Keynesian Assumptions in the Aggregate Demand and Aggregate Supply Model

- Macroeconomic Externality

- Expenditure Multiplier

- The Phillips Curve

- Keynesian Approach to Unemployment and Inflation

- Keynesian Perspective on Market Forces

- NeoClassical Economics

- Long Run Potential GDP

- Physical Capital Affects Productivity

- Potential GDP in the Aggregate Demand Aggregate Supply Model

- Prices are Flexible in the Long Run

- Keynesian and NeoClassical View of Long-Run Aggregate Supply and Demand

- Speed of Macroeconomic Adjustment of Wages and Prices

- Paradox of Rationality

- Rational Expectations Theory

- Shapley Value

- Mechanism Design Theory

- What is the Adaptive Expectations Theory

- Measure Inflation Expectations

- Neoclassical Phillips Curve Tradeoff

- Neoclassical View of Unemployment

- Neoclassical View of Recessions

- Keynesian vs Neoclassical Macroeconomic Policy Recommendations